Reflektory

Venture Capital Associate, Venture Capital Analyst, Venture Capital Investment Professional, Venture Capital Partner, Venture Capital Principal, Venture Capital Fund Manager, Venture Capital Managing Director, Venture Capital Investor, Early-stage Investor, Startup Investor

Inwestorzy venture capital poświęcają swój czas na pozyskiwanie funduszy, znajdowanie startupów do zainwestowania, negocjowanie warunków transakcji i pomaganie startupom w rozwoju.

- Pomoc innowacyjnym firmom w uzyskaniu finansowania i rozwoju

- Bądź przedsiębiorczy bez konieczności bycia przedsiębiorcą

- Potencjalnie lukratywne finansowo

Inwestorzy venture capital prowadzą szybką karierę. Duża część ich pracy polega na wysyłaniu wiadomości e-mail, wiadomości tekstowych, rozmowach telefonicznych i spotkaniach osobistych. W ciągu typowego dnia będą oni

- Pozyskiwanie nowych startupów do inwestowania i rozwijanie relacji z założycielami.

- Realizacja transakcji: Przeprowadzanie due diligence potencjalnych inwestycji w startupy, analizowanie ich rynków i prognoz finansowych oraz negocjowanie warunków transakcji.

- Wsparcie dla spółek portfelowych: Pomaganie spółkom portfelowym we wszystkich aspektach ich działalności, aby mogły się rozwijać i skalować. Jeśli spółki portfelowe odnoszą sukcesy, firma venture capital odnosi sukcesy.

- Nawiązywanie kontaktów: Nawiązuj relacje z prawnikami i bankierami, którzy współpracują ze startupami, aby mogli polecać Ci firmy. Bierz udział w wydarzeniach i konferencjach, oceniaj konkursy pitchingowe.

- Budowanie marki: Publikowanie treści na blogu. Występuj gościnnie na panelach i dziel się tezami inwestycyjnymi firmy. Im bardziej znana jest firma VC, tym łatwiej jest przekonać pożądanego założyciela do współpracy z Twoją firmą.

- Pozyskiwanie funduszy i relacje z komandytariuszami (LP): Pomoc firmie w pozyskiwaniu nowych funduszy oraz aktualizowanie i utrzymywanie relacji z partnerami biznesowymi.

- Operacje wewnętrzne

- Networking: Solidna sieć ograniczonych partnerów i seryjnych przedsiębiorców. Możliwość znalezienia nowych inwestorów i nowych firm do zainwestowania.

- Sprzedaż: Silny dostęp do wysokiej jakości przepływu transakcji i zdolność do zamykania transakcji.

- Umiejętności analityczne

- Przedsiębiorczość

- Cechy podobne do mentora

- Praca w sieci:

- Doświadczenie w domenie (e-commerce, SaaS... itp.)

- Dalekowzroczność: Długoterminowa wizja i umiejętność dostrzegania szans na rynku. Zrozumienie, czy firma ma zdolność do rozwoju i skalowania, biorąc pod uwagę jej zespół, rynek, strukturę finansową i wizję produktu lub usługi.

- Kreatywność i rozwiązywanie problemów: Zdolność do pomagania założycielom spółek portfelowych w radzeniu sobie z ich największymi wyzwaniami.

Bycie inwestorem venture capital to kariera wymagająca długiego czasu i rezultatów. Aby odnieść sukces, firmy, w które inwestujesz, muszą odnieść sukces. Zanim zostaniesz zatrudniony w firmie, będziesz już musiał wykazać się sukcesem we własnym biznesie lub w podobnej sytuacji finansowej.

Bycie odnoszącym sukcesy inwestorem venture capital wymaga cierpliwości. Nawet po znalezieniu stanowiska w firmie, istnieje prawdopodobieństwo, że firma może upaść.

Zostanie VC zazwyczaj wiąże się z odniesieniem sukcesu w finansach lub jako przedsiębiorca. Oznacza to, że będziesz musiał porzucić karierę, przez którą prawdopodobnie już się pociłeś, aby zacząć od nowa.

Twoja praca będzie zazwyczaj polegać na znajdowaniu finansowania dla projektów inwestycyjnych - będziesz odmawiać wielu osobom, które próbują zrealizować swoje marzenia. Możesz również zgodzić się na projekty, które mogą spowodować utratę funduszy inwestorów (komandytariuszy). Jako część firmy będziesz nie tylko zapewniać kapitał, ale także kierować przedsiębiorcami, prowadząc ich.

Big Data nadal dostarcza informacji sektorowi finansowemu. Jednak VC są nadal postrzegani jako osoby, które interpretują dane i ufają ich "przeczuciom". Umiejętność przetwarzania i analizowania danych wraz z algorytmami przetwarzania komputerowego stała się poszukiwaną umiejętnością.

"Seed Investing", czyli inwestowanie na bardzo wczesnych etapach rozwoju firmy, zyskuje na popularności. Po części ma to na celu konkurowanie z internetowymi działaniami crowdsourcingowymi.

- Rozmawianie z wieloma różnymi typami ludzi

- Lubią przekonywać znajomych do swoich pomysłów

- Przedsiębiorczy: Sprzedawać rzeczy

- Dobry w matematyce

- Analityczny, rozwiązujący problemy

- Licencjat - finanse, rachunkowość, ekonomia lub podobne.

- Studia magisterskie - administracja biznesowa

- Według Crunchbase, ~75% inwestorów Venture Capital posiada zaawansowany stopień naukowy. Spośród nich 51% ukończyło studia MBA

- Badanie Crunchbase wykazało, że tylko 12 szkół wykształciło ~42% wszystkich VC. Nic dziwnego, że na szczycie listy znalazły się takie uczelnie jak Harvard, Stanford, UPenn, MIT i Columbia

- Większość firm venture capital poszukuje osób zorientowanych na karierę, które są już na szczycie swojej dziedziny. Awans w sektorze finansowym często oznacza tytuł magistra administracji biznesowej. Nawet z takim wykształceniem, droga do zostania inwestorem Venture Capital jest bardzo trudna.

- Możliwe jest również wejście na rynek po pomyślnym założeniu i posiadaniu własnej firmy jako przedsiębiorca. Osoby fizyczne wykorzystały udaną własność firmy do roli w firmie VC lub były w stanie założyć własną firmę. Sukces w biznesie ORAZ edukacja sprawiają, że jesteś znacznie bardziej atrakcyjny dla potencjalnych partnerów i inwestorów.

- Zaopatrz się w kursy z matematyki, biznesu i finansów, a także zajęcia rozwijające umiejętności pisania, mówienia i prezentacji.

- Dowiedz się, jak uważnie czytać i rozumieć biznesplany, aby określić, czy są one dobre, czy nie.

- Zgłaszanie się na ochotnika do pomocy przy uruchamianiu nowych programów i inicjatyw w celu zdobycia doświadczenia w rozwiązywaniu problemów wspólnie z innymi.

- Dowiedz się wszystkiego o inwestowaniu, czytając książki i oglądając filmy.

- Poszukaj startupów, którym możesz zaoferować bezpłatne usługi konsultingowe podczas nauki

- Poszukaj mentorów, którzy poprowadzą cię na twojej ścieżce i zaoferują porady po drodze.

- Złóż wniosek o pracę dla stażysty Venture Capital

- Pisz na platformach takich jak Medium, Quora i LinkedIn, aby dzielić się swoją wiedzą i zyskać rozgłos.

- Dołącz do profesjonalnych organizacji, takich jak National Venture Capital Association.

- Rozwijaj swoją sieć kontaktów i staraj się nawiązywać znaczące kontakty z liderami biznesu.

- Ćwicz handel akcjami za pomocą symulatorów, takich jak Thinkorswim, Moomoo, TradeStation, Warrior Trading i NinjaTrader Free Trading Simulator.

- Graj w gry inwestycyjne, takie jak Build Your STAX, The Stock Market Game, Wall Street Survivor lub How Market Works.

Praca w firmie Venture Capital oznacza, że spędziłeś już czas w finansach. Znalezienie pracy jest często wynikiem znalezienia kandydata przez rekrutera. Jeśli uważasz, że byłbyś doskonałym kandydatem, możesz wziąć udział w teście zdolności Venture Capital Guya Kawasaki.

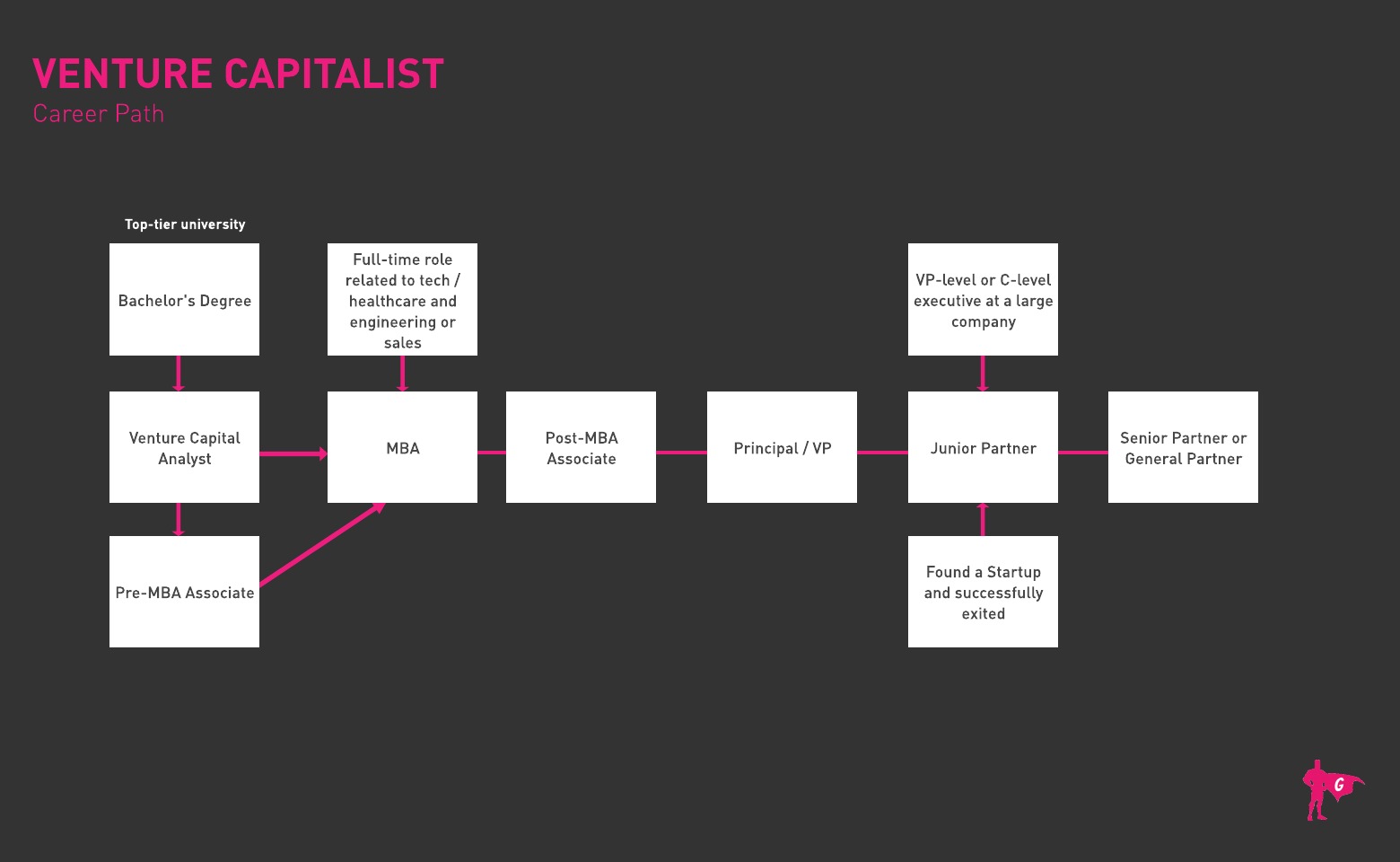

Istnieje wiele ścieżek do zostania inwestorem venture capital:

Ścieżka 1: Doświadczenie w branży

- Założenie firmy lub odgrywanie ważnej roli w startupie na wczesnym etapie rozwoju, który osiągnął dobre wyniki.

- Pracować dla dużej korporacji na odpowiednim stanowisku i stać się ekspertem w tej branży.

- Zbuduj swoją reputację społeczną

- Połącz się w sieć, a nadarzy się okazja

Ścieżka 2: Finanse

- Praca w bankowości inwestycyjnej, finansach korporacyjnych, doradztwie strategicznym

- Uzyskaj tytuł MBA w renomowanej szkole biznesu

- Zacznij jako analityk i awansuj

Analityk

Od roku do dwóch lat wcześniejszego doświadczenia zawodowego w startupie, banku inwestycyjnym (bardzo często koncentrującym się na sektorach technologicznych) lub firmie doradztwa strategicznego. Analitycy mogą awansować na poziom associate po kilku latach, ale wielu z nich decyduje się na studia MBA lub wybiera drogę przedsiębiorczości, zakładając własne firmy.

Associate

Associates osiągają kolejny poziom w hierarchii i znajdują się na "ścieżce partnerskiej", co oznacza, że oczekuje się od nich pozostania w firmie aż do osiągnięcia statusu partnera. Associates to zazwyczaj byli bankierzy, konsultanci, specjaliści inwestycyjni (np. private equity, inne fundusze VC) lub liderzy operacyjni z trzy- lub pięcioletnim doświadczeniem, czasem z dyplomem MBA lub doktoratem. Associates zazwyczaj awansują na stanowiska kierownicze po kilku latach skutecznego przeprowadzania transakcji. Niektórzy z nich również odchodzą, aby stworzyć własne firmy.

Partner

Najlepiej ktoś z doświadczeniem w zakresie przedsiębiorczości - nawet jeśli te przedsięwzięcia zakończyły się niepowodzeniem. Sukcesy są świetne (nawet jeśli małe), zwłaszcza jeśli przedsiębiorca zbudował i sprzedał firmę w domenie, która jest przedmiotem zainteresowania firmy VC. Droga przedsiębiorcy zazwyczaj prowadzi do zostania EIR (Entrepreneur-in-Residence), który często przyjmuje różne role, od selekcji transakcji, przez zasiadanie w zarządzie, po zostanie GP w firmie.

Następną najlepszą ścieżką jest stanowisko "Associate", "Principal" lub "VP" w firmie venture, ale lepiej mieć głębokie zdolności finansowe i analityczne poparte silną etyką pracy.

Jeśli chodzi o ścieżkę Venture Partner: idealna osoba do tej roli byłaby zazwyczaj zatrudniona na stanowisku operacyjnym przez wiele lat.

Uwaga: Te stanowiska nigdy nie są ogłaszane. Osoby zatrudniane na poziomie partnera prawie zawsze są kimś, kogo partnerzy w firmie VC już znają (np. CEO byłej spółki portfelowej).

Jeśli firma VC zwróci się do ciebie z prośbą o pomoc w przeprowadzeniu analizy due diligence lub przedstawienie spostrzeżeń na temat potencjalnej transakcji, może to być tylko test przed faktyczną rolą VC.

Zakładając, że masz już pożądany zestaw umiejętności, oto cztery sugestie, jak zacząć pokazywać, że masz zdolności, odwagę i wizję, aby zostać VC:

- Zdobądź stanowisko stażysty w firmie VC (a o takie stanowiska nie jest łatwo), a następnie, po wejściu do środka, stań się niezastąpiony.

- Zdobądź doświadczenie, inwestując własne pieniądze w transakcje z aniołami biznesu.

- Zasiadanie w radach doradczych startupów i mentorowanie przedsiębiorców w docelowej przestrzeni.

- Prowadź zajęcia i regularnie bloguj.

Analityk

Nawiązują kontakty, biorą udział w wydarzeniach branżowych i VC, śledzą najnowsze trendy w branży i dzwonią do potencjalnych spółek docelowych, aby dowiedzieć się więcej o ich działalności i umówić się na spotkanie z założycielami. Mogą również w pewnym stopniu zaangażować się w proces transakcji (tj. due diligence, analizę rynku, niektóre prace związane z wyceną), ale ich uwaga skupia się głównie na "inicjowaniu".

Współpracownik

Rola ta jest bardziej skoncentrowana na due diligence, analizie biznesplanów, przeprowadzaniu transakcji, analizowaniu interesujących podsektorów branżowych i pomaganiu spółkom portfelowym. Jest to bardziej analityczna i transakcyjna rola w ramach funduszu VC.

Dyrektor

Dyrektorzy są odpowiedzialni za sprawne funkcjonowanie spółek portfelowych i będą zasiadać w zarządzie kilku spółek portfelowych. Ponadto ich rolą jest nawiązywanie kontaktów i identyfikowanie interesujących możliwości dla funduszu w celu negocjowania warunków przejęć, a także pomyślnego wyjścia ze spółek portfelowych. Dyrektorzy zwykle pozostają do czasu awansu na poziom partnera, co ma miejsce, gdy udowodnią swoją zdolność do generowania dobrych transakcji dla firm i generowania zwrotów.

Partner

Partnerzy i dyrektorzy mają bardzo podobne role w firmie. Jednak partnerzy są zwykle mniej zaangażowani w codzienne zawieranie transakcji i są bardziej skoncentrowani na zadaniach wysokiego szczebla, takich jak identyfikacja kluczowych sektorów do inwestowania, dawanie zielonego światła dla inwestycji i wyjść, zasiadanie w zarządzie niektórych spółek portfelowych, nawiązywanie kontaktów na wysokim poziomie, reprezentowanie całej firmy, a także pozyskiwanie pieniędzy dla firmy (co pięć do siedmiu lat) i informowanie inwestorów o wynikach.

Strony internetowe

- Amerykańska Rada Inwestycyjna

- Stowarzyszenie Angel Capital

- Sieć aniołów biznesu

- Globalne Stowarzyszenie Kapitału Prywatnego

- Międzynarodowe Stowarzyszenie Innowacji Biznesowych

- Krajowe Stowarzyszenie Venture Capital

- Private Equity Growth Capital Council

- Small Business Investor Alliance

- Stanowa inicjatywa kredytowa dla małych przedsiębiorstw (SSBCI)

- Venture Forward

Książki

- The Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, autor: Mahendra Ramsinghani

- Prawo władzy: Venture Capital and the Making of the New Future, autor: Sebastian Mallaby

- Venture Capital i finansowanie innowacji, Andrew Metrick i Ayako Yasuda

- Venture Deals: Bądź mądrzejszy od prawnika i inwestora venture capital, Brad Feld i Jason Mendelson

- Private Equity

- Bankowość inwestycyjna

- Makler giełdowy

- Bankier

- Ubezpieczyciel inwestycyjny

- Przedsiębiorca

Zostanie inwestorem venture capital to interesująca ścieżka. Będziesz musiał odnieść sukces gdzie indziej, ponieważ firmy są zainteresowane rekrutacją osób, które już wykazały się wiedzą i działaniami niezbędnymi do odniesienia sukcesu. Spodziewaj się ciężkiej pracy przez kilka lat w sektorze finansowym lub jako przedsiębiorca prowadzący udane przedsięwzięcia biznesowe na własną rękę.

Może się okazać, że korzystasz z usług firmy VC w swojej własnej firmie! Może to pozwolić ci wykorzystać relacje zbudowane podczas procesu i zapewnić ci wejście do firmy. Podobnie jak w przypadku większości stanowisk w sektorze finansowym, networking jest jedną z najważniejszych umiejętności, jakie można posiadać po uzyskaniu wyników.

Firmy VC będą zainteresowane, jeśli nawiązałeś w nich kontakty i jeśli wykazałeś się zdolnością do generowania zysków w innych dziedzinach. Jest to dziedzina zbudowana z wypróbowanych i odnoszących sukcesy.

Kanał informacyjny

Polecane oferty pracy

Kursy i narzędzia online